Earlier this month, Robert Murray, President and CEO of coal giant Murray Energy Corporation, sparred with Tesla founder Elon Musk on the issue of subsidies. Murray called Tesla a “fraud” for failing to achieve a profit despite benefitting from consumer-facing electric vehicle tax credits, and then Musk lobbed back that EVs get “pennies on the dollar” compared to coal.

We reported the exchange here and on DeSmog, adding some background on how the coal industry and companies like Murray actually do benefit from a broad range of subsidies. Murray took exception, and sent the following note to the managing editor of DeSmog:

Murray referenced data from this CNBC article: Musk fires back at coal CEO who called Tesla a ‘fraud’, that uses perfectly legitimate data from the Energy Information Agency (EIA) about subsidies for electrical generation from coal, solar, wind, and other sources.

The problem with Murray’s argument is that the data he cites has absolutely nothing to do with any of the points made about subsidies for coal and EVs.

First of all, the data Murray cites confirms that the coal industry receives over $1 billion in subsidies for electricity production alone. From the CNBC article Murray referenced:

In 2013, electricity production and federal utilities that rely on coal received $1.08 billion in direct cash outlays through federal programs, tax benefits, research and development funding, loans and guarantees, the EIA found.

That’s half of the $2 billion that Murray ridiculed Tesla for “receiving.” But keep in mind that Tesla didn’t get any such direct cash outlays, but rather the American car buyers that choose to buy a Tesla or any other electric vehicle receive this cash.

Moreover, that $1.08 billion is a tiny slice of the full coal subsidy pie. The EIA data is, by the EIA’s own description, limited in scope. Here’s how the agency describes the data in the second paragraph of their report:

As in the prior EIA reports on this subject, the scope of the present report is limited to direct federal financial interventions and subsidies that are provided by the federal government, provide a financial benefit with an identifiable federal budget impact, and are specifically targeted at energy markets. As requested, the report focuses on subsidies to electricity production and also includes subsidies to federal electric utilities in the form of financial support.

Given its scope, the report does not encompass all subsidies beneficial to energy sector activities (see text entitled “Not All Subsidies Impacting the Energy Sector Are Included in this Report”), which should be kept in mind when comparing this report to other studies that may use narrower or more expansive inclusion criteria.

So what types of subsidies to coal aren’t included in the EIA’s accounting? There are a whole range—many of which we described in the original article—and different entities define subsidy in different ways, as the EIA notes above.

The International Monetary Fund’s Post-Tax Coal Subsidy Calculation

The International Monetary Fund (IMF) provides a revealing contrast to the EIA’s numbers. The authoritative international financial organization with 189 member countries calculates post-tax subsidies for various energy sources. Here’s how the IMF defines these post-tax subsidies:

The energy subsidy estimates reported here are based on the broad notion of post-tax subsidies, which arise when consumer prices are below supply costs plus a tax to reflect environmental damage and an additional tax applied to all consumption goods to raise government revenues. Pre-tax subsidies, which arise when consumer prices are below supply costs, are also reported as a component of post-tax subsidies. These subsidies will not necessarily coincide with definitions used by governments or with their reported subsidy numbers.

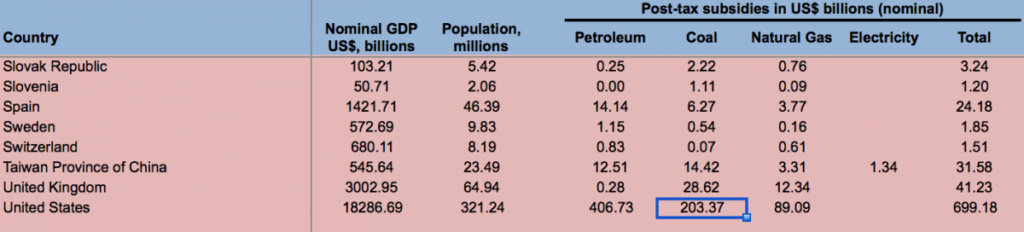

According to the IMF, in the United States, coal benefits from over $203 billion in post-tax subsidies every year.

This $203 billion includes factors like forgone tax revenues, the costs of climate change impacts, air pollution, and more. Only one country, China, provides greater post-tax subsidies to coal than the United States.

While the IMF doesn’t itemize all of the various subsidies that make up this total, we can survey a number of the elements as defined, described, and calculated by other organizations.

Subsidized transportation by rail and barge

According to the G20’s peer review of inefficient fossil fuel subsidies, data from the U.S. Department of Transportation indicates that coal is among the top commodities transported on America’s railways. The reports also cites Association of American Railroads numbers from 2013, which reveal that coal “accounted for almost 40 percent of tonnage,” but only generated “nearly 20 percent of rail revenue for U.S. Class I railroads.” In essence, coal is afforded half-price transportation along America’s railways.

With transport-by-barge, according to the G20 report, “$923 million are spent annually on the operation or maintenance and construction of inland waterways,” and “operation and maintenance costs are fully borne by the U.S. Treasury, whereas construction costs are equally split between the Inland Waterway Trust Fund and Treasury.”

Fossil fuels make up 56-percent of the volume of freight transported on America’s inland waterways. The G20 review “argues that responsible parties are not paying their fair share to cover the costs of upgrading and maintaining waterway infrastructure. This revenue shortfall imposes substantial costs on the federal Inland Waterways Trust Fund, the U.S. Treasury and, eventually, the taxpayer.”

State-level subsidies

States with major coal resources like West Virginia, Kentucky, and Wyoming offer a great range of subsidies—direct and indirect, pre- and post-tax—to the coal industry, and these aren’t factored by the EIA data. An EarthTrack report from 2012 reviews fossil fuel subsidies in five states, including coal support in Kentucky and Wyoming. In Kentucky alone, EarthTrack identified roughly $1 billion in state-level subsidies.

One post-tax form of state-level subsidy is “self-bonding,” which allows mining companies to pay for the mine reclamation that is required by the Surface Mining Control and Reclamation Act. A 2015 report by Carbon Tracker and the Institute for Energy Economics & Financial Analysis last year estimated that self-bonding in the Powder River Basin created an addition subsidy of $0.78 per ton of coal mined.

Below market leases on America’s public lands

Through competition-free leases, royalty rate reductions, and other quirks of the federal coal leasing program (that has since been placed on a moratorium), each ton of coal from these federal lands receives on average about $8 per ton in subsidies. All told, Carbon Tracker and the Institute for Energy Economics & Financial Analysis calculate that coal companies operating in the Powder River Basin alone are subsidized to the tune of $4.6 billion per year.

The unpaid external costs of coal

The EIA doesn’t factor any external costs into their calculations, though many experts (including those at the IMF) consider the failure to include external costs a subsidy. To that end, the National Research Council, an arm of the National Academy of Sciences, found in 2009 that the “hidden” costs of air pollution from coal combustion amount to around $62 billion. Ordered by a Republican Congress to conduct the study, the NRC found:

In 2005 the total annual external damages from sulfur dioxide, nitrogen oxides, and particulate matter created by burning coal at 406 coal-fired power plants, which produce 95 percent of the nation’s coal-generated electricity, were about $62 billion

Crucially, according to the NRC, “the figure does not include damages from climate change, harm to ecosystems, effects of some air pollutants such as mercury, and risks to national security.”

A few years later, in a 2011 study, Dr. Paul Epstein of Harvard Medical School’s Center for Health and the Global Environment attempted to quantify how harmful coal is in terms of local impacts alone:

Our comprehensive review finds that the best estimate for the total economically quantifiable costs, based on a conservative weighting of many of the study findings, amount to some $345.3 billion, adding close to 17.8¢/kWh of electricity generated from coal. The low estimate is $175 billion, or over 9¢/kWh, while the true monetizable costs could be as much as the upper bounds of $523.3 billion, adding close to 26.89¢/kWh. These and the more difficult to quantify externalities are borne by the general public.

Ultimately, comparing subsidies across technologies comes down to the scope and definition of the subsidy. The EIA’s $1.08 billion figure only looks at federal support or tax credits that have an “identifiable federal budget impact” and directly target energy markets.

The Organisation for Economic Co-operation and Development (OECD), calculates global inventories of fossil fuel subsidies, and found that “total producer support” for coal in the United States, “including tax expenditures at the federal level and for some states, represented about $6 billion in 2011.”

The IMF includes a number of external costs like the impacts of climate change and to public health, and comes up with a whopping $203 billion worth of subsidies for the coal industry.

We will continue to take a much closer look at subsidies—comparing and contrasting government support for fossil fuels and for renewable energy and clean tech—in an ongoing series here and on Koch Vs Clean, a project of DeSmog that exposes the Koch-funded groups attacking clean energy solutions and propping up the dying fossil fuel industry.

Blog Image: Greg Goebel on Flickr