Throughout the country, the oil industry is pushing for legislation to penalize drivers of electric vehicles (EVs) through annual registration fees—or EV fees—that exceed those paid by drivers of gas-powered cars. As of September 2019, a total of 20 states force EV drivers to pay extra annual registration fees, and eight more states have passed bills to introduce new fees in coming years.

As the policy gains traction, the federal government is considering introducing new user fees for EV drivers nationwide, with Senator John Barrasso, a Wyoming Republican, leading the effort.

Proponents of higher EV fees say that they are necessary to ensure that plug-in cars pay their fair share for the roads. In the United States, highway funds are typically raised from revenue from gasoline taxes. Because EV drivers don’t buy gas, they aren’t chipping in for those highway funds, the argument goes.

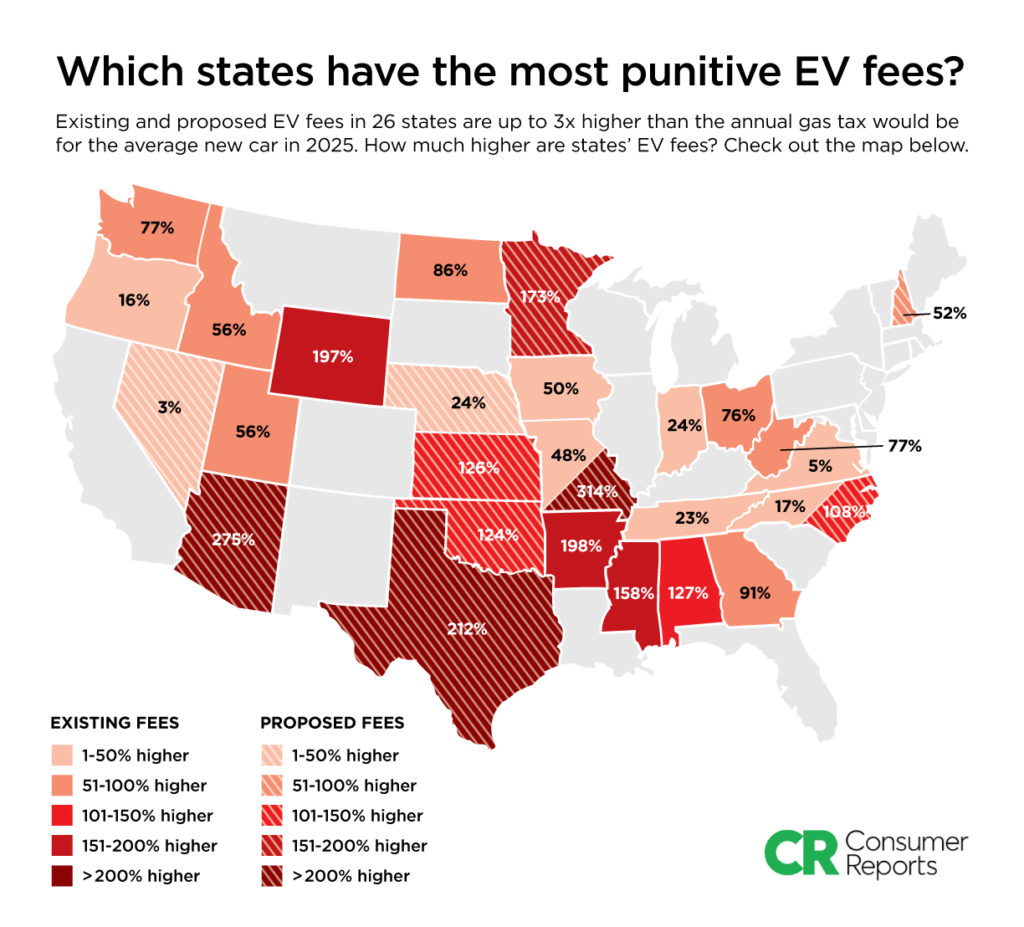

However, according to a recent analysis by Consumer Reports, the fees enacted or proposed in 26 states are considered “punitive,” or more expensive than the gas taxes paid by the driver of an average new gasoline vehicle.

A map of U.S. states with existing or proposed EV fees and how much more they are compared to the annual gas tax. Credit: Consumer Reports

How Big Oil Is Behind the Push for EV Fees

These punitive EV fees have been pushed in many states by the American Legislative Exchange Council (ALEC), the Koch-controlled and corporate-funded group which produces model legislation and voted on a model resolution supporting “equal tax treatment for all vehicles” — a move that bears the fingerprints of the fossil fueled–Koch network.

The ALEC resolution which passed last November claimed:

WHEREAS, certain vehicles, due to their fuel or propulsion systems, use little or no liquid fuels and therefore do not contribute to the tax revenue used for road construction and maintenance; and

WHEREAS, many non-liquid fuel vehicles are heavier than comparably sized liquid-fueled vehicles, largely due to the onboard battery packs, and thus cause more wear and tear on road infrastructure; and

WHEREAS, the elimination of special-interest tax credits for vehicles, and the establishment of a system under which the owners and operators of all vehicles using public roads share in the cost of construction and maintenance for those roads, do comply with and reflect principles of “economic neutrality,” and “equity and fairness,” principles of taxation;

THEREFORE, BE IT RESOLVED that as a part of revenue-neutral tax reform {state} specifically supports efforts to eliminate federal tax credits for new qualified plug-in electric drive motor vehicles and the creation of an alternative fuel vehicle user fee whose revenue can be used to support highway construction and maintenance.

Despite ALEC‘s claims, EVs are far less of a burden on the roads than larger SUVs and heavy-duty trucks, and create other economic benefits by improving air quality because they don’t have tailpipes spewing dangerous emissions.

The misinformation about electric vehicles is unsurprising, given that Charles Koch and the Koch network now more or less control ALEC, as described in this recent post on the Koch-dedicated web archive KochDocs. In fact, Grant Kidwell, who manages the Energy, Environment and Agriculture Task Force for ALEC, was until recently employed by the Charles Koch Institute and Americans for Prosperity, the main political advocacy arm of the Koch network.

This very model resolution that coincided with the recent spike in state EV fee bills was itself shepherded into the ALEC committee by Tom Pyle, president of the Koch-funded American Energy Alliance and a former lobbyist for Koch Industries.

Emails obtained by Documented, a corporate influence watchdog, confirmed an E&E News report that Pyle was behind the model resolution. In the emails, Pyle writes, “Attached is a resolution for consideration supporting equal tax treatment for all vehicles. Representative Thompson has kindly agreed to be the public sector sponsor (at least for now).”

Tom Pyle’s email pushing the ALEC model resolution imposing higher fees on electric cars.

The correspondence reveals how Pyle finds a “sponsor” for the model resolution, and how the legislator and Pyle both approve edits that are suggested by Kidwell. Though ALEC likes to claim that its public sector representatives introduce the model legislation, in the case of this EV tax bill, it was clearly born of a Koch-funded entity.

More resources:

-

Sierra Club, EV Fees Fact Sheet

-

Consumer Reports, Rising Trend of Punitive Fees on Electric Vehicles Won’t Dent State Highway Funding Shortfalls but Will Hurt Consumers

-

ClimateWire, “A look into Big Oil’s fight against electric cars“