The Economics of Electric Vehicles

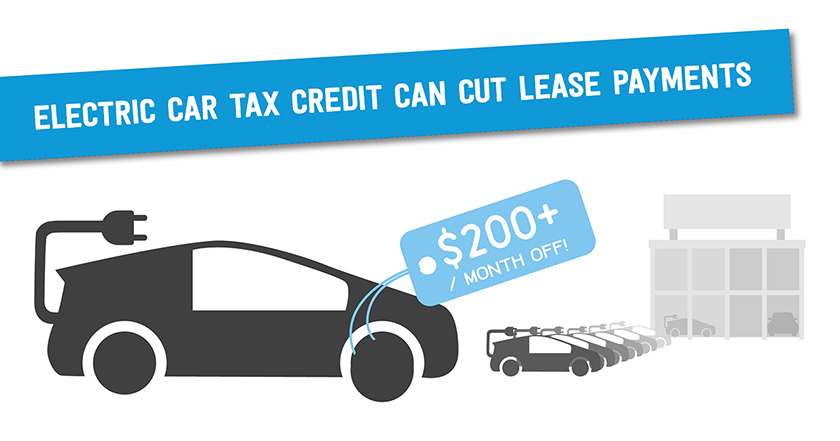

- The EV tax credit benefits drivers of all income levels.

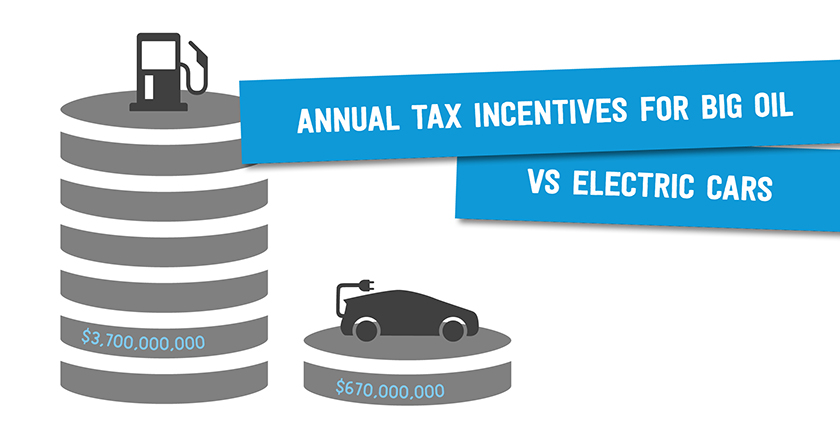

- Tax breaks to the oil and gas industry cost taxpayers more than the EV tax credit.

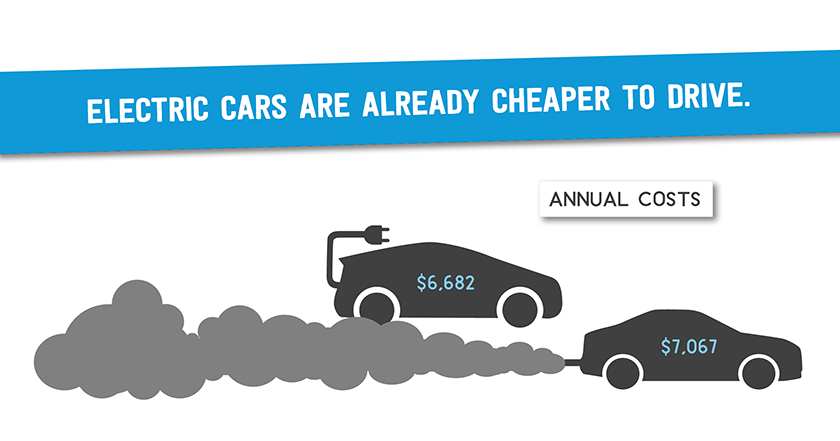

- Electric cars are cheaper to own and operate than comparable gas-powered cars.

- Many EV models available today are cheaper than the average cost of a new car.

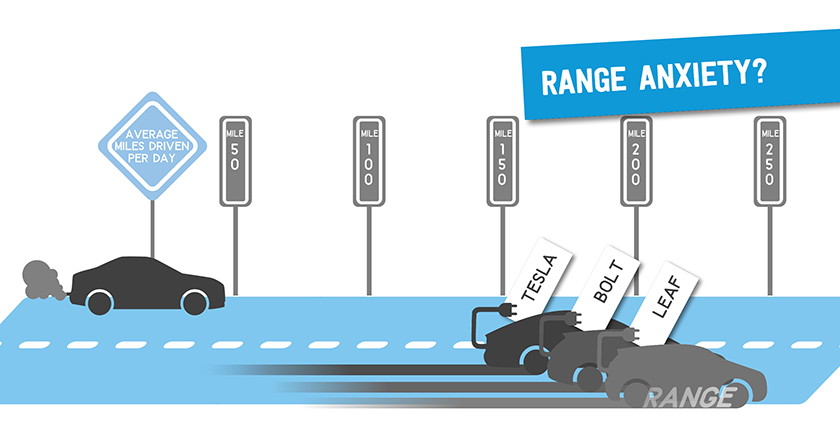

- Electric car ranges are practical for most American households.

- Most EV charging is done at home and public chargers are rapidly spreading.

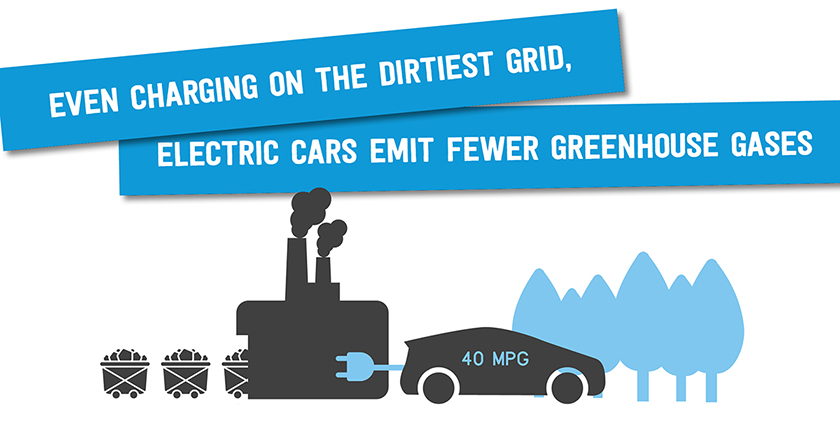

- Electric cars are better for the climate, no matter how they are charged.

- Over the full life cycle of the vehicle, electric cars are greener.

- Electric car batteries don’t use rare earth metals, but do use the same materials as most consumer electronics…and gas-powered cars.

- Electric car batteries can be recycled.

Debunking the Koch-Funded Reports

When spreading these anti-EV talking points, commentators will often reference the same handful of reports and studies, most of which are linked connected to Koch and oil industry funding. Learn more about these reports, including who wrote and paid for them, and find links to the best rebuttals and debunkings below. ‘Short Circuit: The High Cost of Electric Vehicle Subsidies’ by Jonathan Lesser for the Manhattan Institute: This report is often cited to support obviously misleading claims that widespread adoption of electric cars would increase air pollution and have a negligible impact on the global climate. ‘Costly Subsides For the Rich’ by Wayne Winegarden for the Pacific Research Institute: This report is often cited to support misleading claims that the EV tax credit only benefits the rich, but it relies on outdated data and entirely ignores the significant role that leased vehicles play in the EV market. AEA Poll on Electric Vehicle Subsidies by MWR Resources for the American Energy Alliance: This classic push poll purports to reveal voter sentiment about the environmental virtues and federal support of electric vehicles, and voter opinions on auto efficiency standards. However, it was commissioned by an oil industry-funded think tank run by a former Koch Industries lobbyist, and was conducted by a polling firm that includes Koch Industries and the American Fuel & Petrochemical Manufacturers among its clients. ‘Economic Impacts of Eliminating the Manufacturers’ Cap on the Plug-In Electric Vehicle Tax Credit’ by NERA Economic Consulting for Flint Hills Resources: This study, commissioned by a subsidiary of Koch Industries and conducted by the firm that produced key reports defending the tobacco industry, is referenced to support macroeconomic arguments against lifting the cap of the EV tax credit.Other Useful EV Mythbusting

Besides our EV facts above, here are some more resources that debunk some of the myths perpetuated by Big Oil and the Koch network about electric cars.- InsideEVs: Top 10 Most Common Electric Car Myths Busted

- Undecided With Matt Ferrell: Electric Cars: Myths vs. Facts